October 22, 2025 | Real Estate Market Update for Northville, Novi, South Lyon, Plymouth and Metro Detroit | Insights by Jeff Duneske, Northville Realtor®

Overview: Market Movement Amid Lower Mortgage Rates

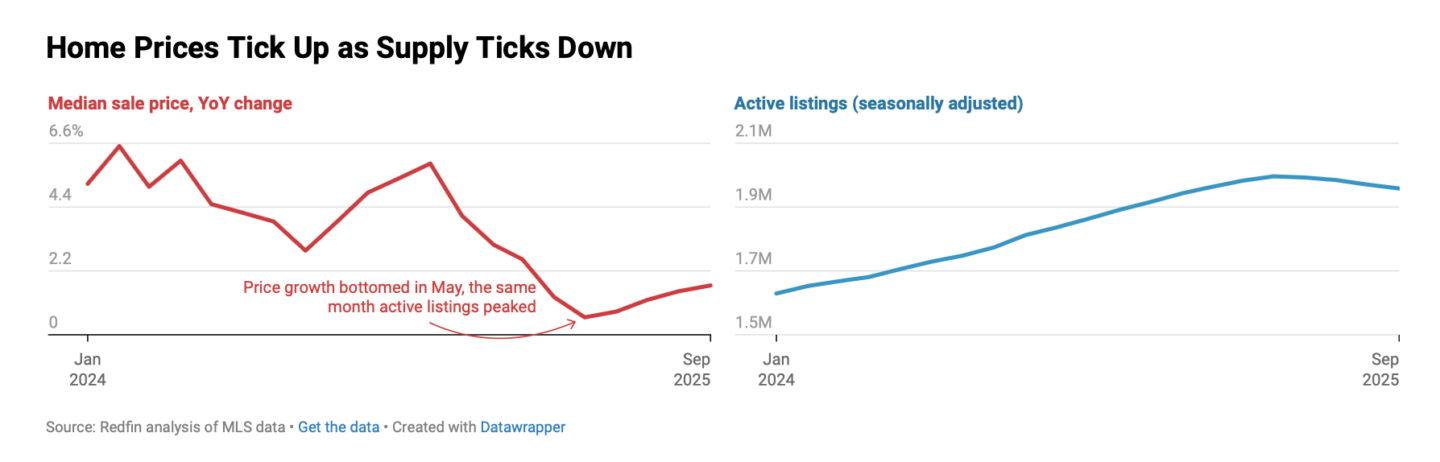

As mortgage rates dip into the low 6% range, national experts like Ryan Serhant remind buyers and sellers that “relief” in the housing market often signals broader economic shifts rather than a clear buyer’s market. With home sales holding near 4 million per year, stability, not steep change, defines the market. Locally across Northville, Novi, South Lyon, and Plymouth, this balance continues to create opportunity for both sides of the table when strategy and timing align.

Serhant cautions that large market “relief” typically comes with economic trouble. A potential Fed rate cut may ease mortgage costs slightly, but uncertainty around government activity and inflation keeps predictions mixed. His advice is simple: “If you see a home that feels right and fits your budget, act decisively, no one can perfectly time the market.”

Down Payments Leveling Off: A Cooler, Steadier Trend

According to Realtor.com, down payments across the U.S. have leveled off, signaling a more balanced environment.

-

The typical down payment remains around 14.4% or $30,400, up 118% from 2019 but unchanged from recent quarters.

-

Luxury sales are driving more of the activity, with homes priced above $750,000 up 5.8% year-over-year, while sub-$750K homes declined 3%.

-

The median FICO score for homebuyers is 735, the highest in over a decade—indicating a market dominated by financially strong buyers.

In Metro Detroit, this pattern shows up in Northville’s and Novi’s upper-tier neighborhoods, where cash-heavy and high-credit buyers are sustaining demand despite affordability pressures. Entry-level and move-up buyers continue to face limited inventory and price friction, keeping competition high in desirable school districts and walkable communities.

Mortgage Activity and Buyer Behavior

The Mortgage Bankers Association reports a 0.3% overall decline in mortgage applications last week, though refinances climbed 4% and ARM (adjustable-rate mortgage) applications jumped 16%. The 30-year fixed rate averaged 6.37%, the lowest in a month. Purchase applications dropped 5% week-to-week but remained 20% higher than one year ago, showing gradual improvement from 2023 lows.

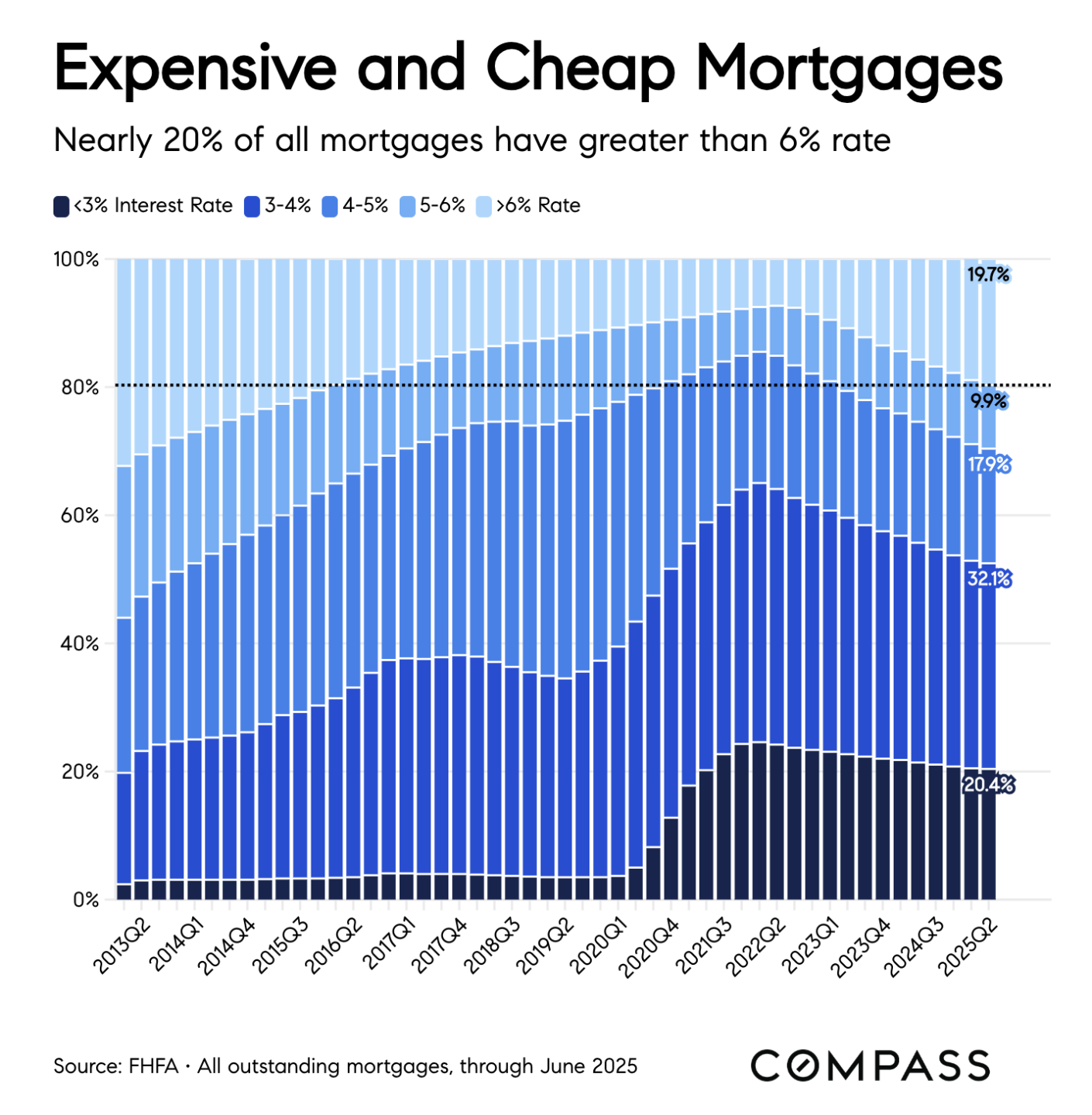

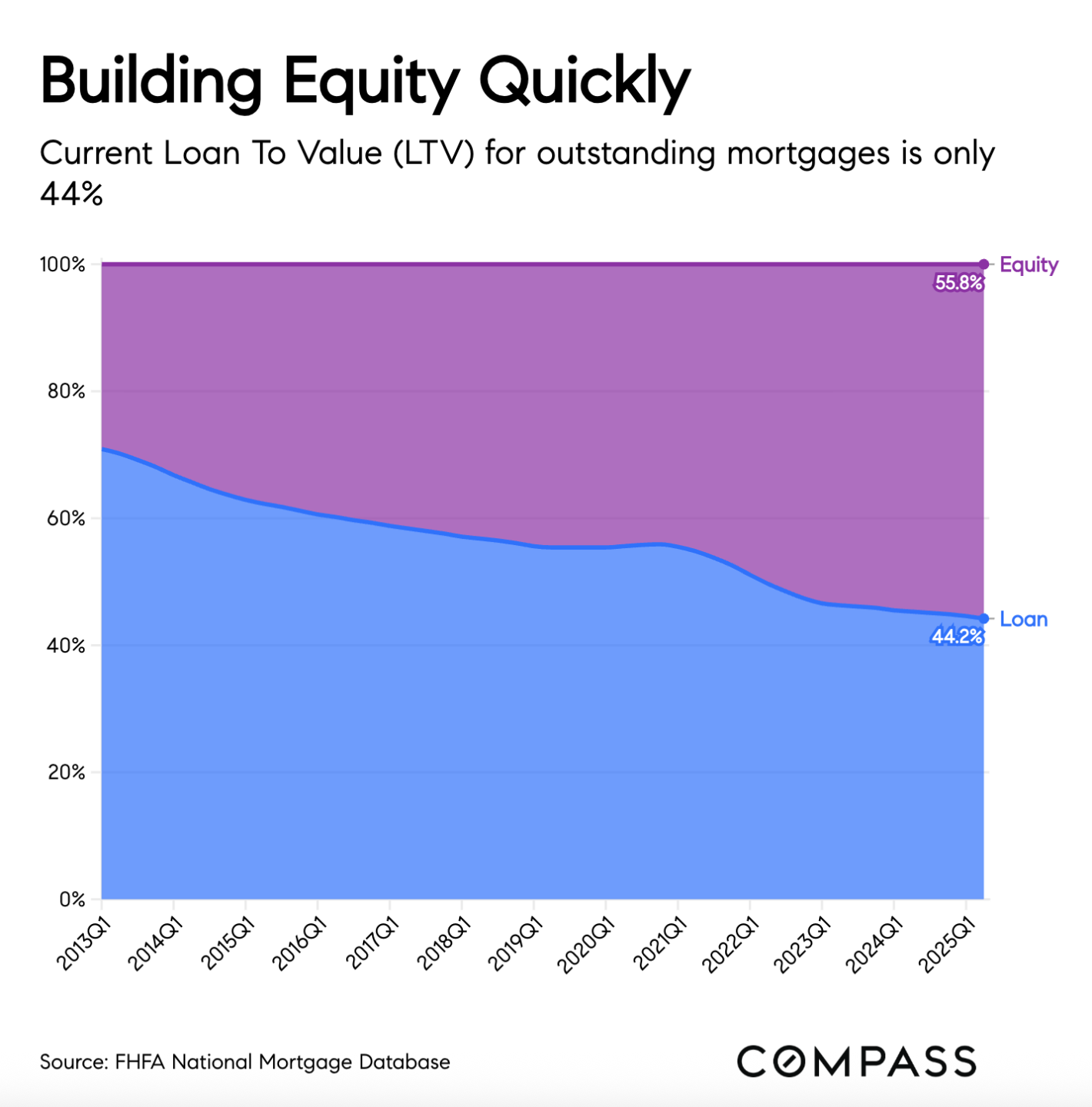

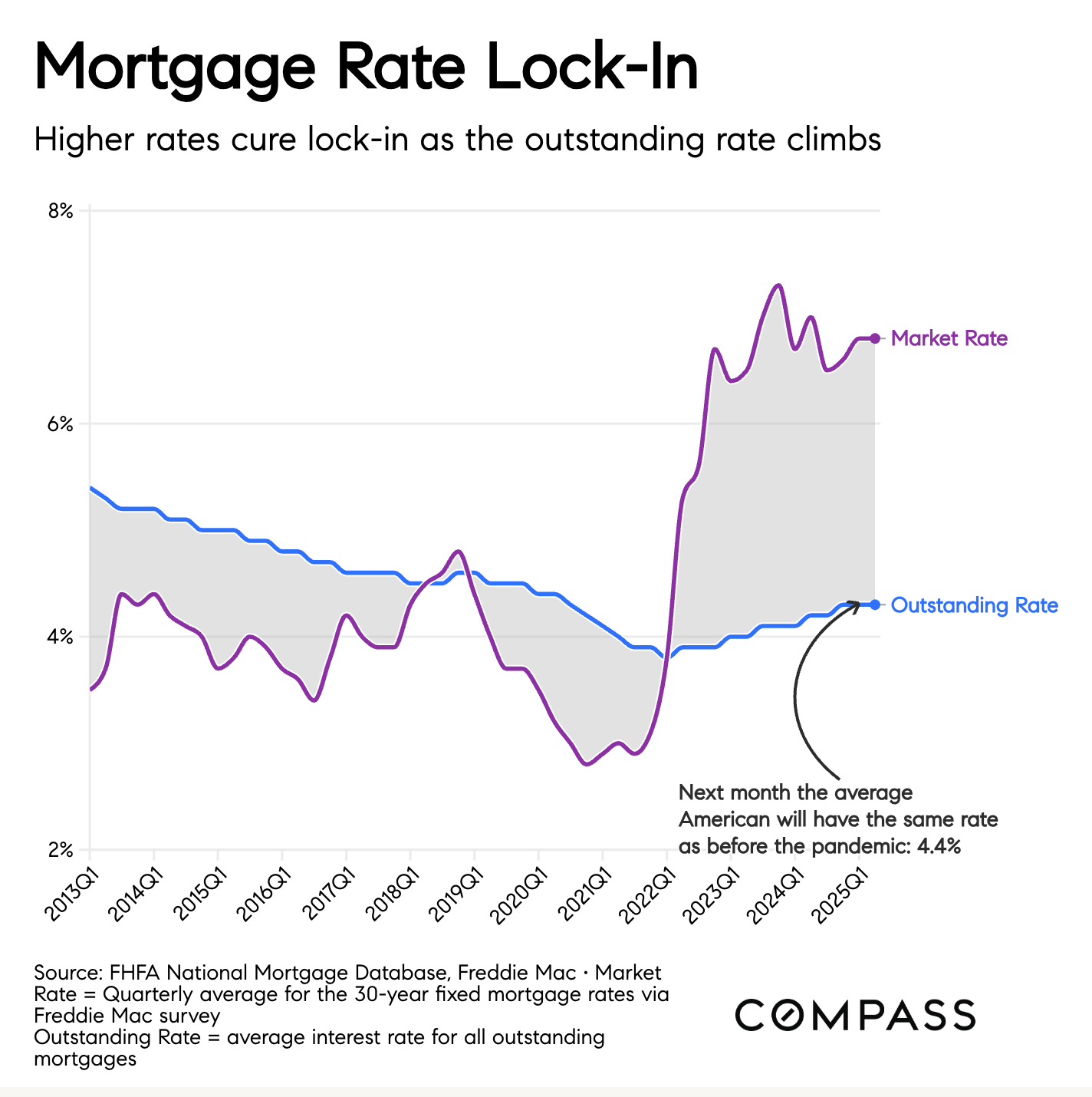

Even as rates ease, the biggest driver remains confidence. Many homeowners locked in between 2013–2016 or 2020–2022 hesitate to move, but for those who do, today’s offers could look like tomorrow’s premiums if the market shifts. Sellers are encouraged to consider their broader financial goals—not just the mortgage rate they’re leaving behind.

Local Insight: What This Means for Metro Detroit

In Northville, Novi, South Lyon, and Plymouth, the fall market is defined by motivated but selective buyers.

-

Homes priced right and presented well continue to move within 30–45 days.

-

Buyers using ARM or cash strategies are becoming more common.

-

Well-positioned listings, especially updated ranch condos and family homes under $700K, remain in short supply.

If you’re thinking about making a move, now is a window of balance—where sellers still hold leverage, but buyers can negotiate smarter before spring competition intensifies.

Final Takeaway

The market isn’t crashing or stalling, it’s normalizing. Rates in the low 6s offer breathing room, and steadier down payments signal greater predictability. As Ryan Serhant put it, “Life is short. At some point, you have to give, and move forward.”

For those considering buying, selling, or rightsizing across Metro Detroit, the key is not waiting for perfect timing, but acting strategically when opportunity aligns with your goals.

Categories

- All Blogs (106)

- Best Agent For… Blog Series - Northville, Novi, South Lyon & Metro Detroit (36)

- Buyers (10)

- Community & Local Events (3)

- Divorce Real Estate (5)

- Estate Planning & Strategy (2)

- Golf Course & Luxury Living (1)

- Homeowners (Maintenance & Equity) (3)

- Investors (1)

- Market Conditions (7)

- Market Updates (Metro Detroit / Local) (42)

- Mortgage & Financing (2)

- New Construction (3)

- Pricing & Home Values (2)

- Relocation & Moving (4)

- Rightsizing & Senior Moves (5)

- Sellers (20)

- Tips, Guides & How-To (7)

Recent Posts

GET MORE INFORMATION

Broker Associate | License ID: 6501297753